Cognac, cars and animal food

Volvo, Manitou, Solutions 30, Symrise, WDP, Roche, Puma, DSM-Firmenich, Swatch, STMicroelectronics and Rémy Cointreau

Volvo (VOLV) Signs of a market turnaround, but margins still under pressure

Volvo’s full-year results were a mixed bag, with a strong rebound in order intake offset by disappointing truck margins. The company’s EBIT came in as expected, but the truck division’s 10.6% margin fell short due to several disruptions in North America. These included the production ramp-up for the new VNL truck, lingering supply chain constraints, and even Hurricane Katrina’s residual impact, which led to some volume losses and higher costs.

Despite these headwinds, management reassured investors that these challenges are temporary and that improvements are already underway.

The real bright spot in Volvo’s report was its strong order intake. For the first time in years, the book-to-bill ratio for both trucks and construction equipment exceeded 1x, suggesting that demand is starting to recover. Management pointed to early signs of an inflection point in the market, with retail customers coming back and the used truck market stabilizing. These are all encouraging indicators that the cyclical downturn seen in 2024 may be starting to reverse.

That said, Volvo didn’t provide concrete financial guidance for 2025, only reaffirming its expectation of a modest market contraction for the year.

Investors hoping for a clearer roadmap may need to wait a bit longer.

The stock is currently trading at 13x forward earnings, a slight premium to its 10-year average. While the long-term recovery story remains intact, other players appear to offer more upside at this stage. For now, Volvo is a case of strong fundamentals, but with much of the good news already priced in.

Manitou (MTU) A tough year, but better days ahead

Manitou’s Q4 results reflected the challenges of 2024 while also hinting at a brighter 2025.

Sales came in at €657 million, marking a steep 19% decline year-over-year and capping off a full-year drop of 7%. While the downturn was expected—especially after management’s October warning—the numbers highlight just how tough the market has been, particularly in Northern Europe. Dealer inventories in Germany and the Nordic countries remain high, slowing demand significantly.

But it’s not all bad news. The Americas returned to growth, posting a 3% increase in sales, suggesting the market is stabilizing. More importantly, Manitou saw a sharp recovery in order intake, racking up €532 million in new orders during Q4. To put that in perspective, the company had only €252 million in new orders in Q3 and a meager €86 million in Q2.

This surge in demand, particularly in the U.S., signals that the worst of the cycle might be behind them. The presidential election outcome seems to have played a role in boosting confidence, alongside Manitou’s recent investments in industrial facilities and new product launches.

For this year, management is now expecting stable sales—a notably more optimistic outlook than previous expectations of a decline. The order backlog of €1.1 billion, roughly equivalent to six months of machine sales, provides a strong cushion moving into the year.

With a potential tailwind from interest rate cuts, which could reinvigorate the construction sector, Manitou might be on the verge of an upcycle. While the stock has been under pressure, the sharp turnaround in orders could be an early sign that things are about to improve.

Solutions 30 (S30) Profitability takes priority

Solutions 30’s Q4 results were another reminder that the company is still in transition mode.

Revenue fell 12% year-over-year to €252 million, marking yet another quarter of double-digit declines. The drop was mainly driven by the company’s strategic shift in its telecom operations, especially in France and Spain, where it has become more selective with contracts. Meanwhile, telecom investment delays in Belgium also contributed to the downturn.

Despite the shrinking top line, the company is improving its bottom line. Management confirmed that EBITDA margins improved in 2024, with absolute EBITDA expected to grow by around 7%.

Essentially, Solutions 30 is focusing on profitability over revenue growth, cutting out less lucrative projects while streamlining operations. This shift is a long-term play to make the company leaner and more efficient, though it does come with short-term pain.

The company has yet to provide formal guidance for 2025, but its roadmap for 2026 remains unchanged. Belgium’s telecom situation is clearing up, which should help stabilize the business there. In France, the energy transition is opening up new opportunities, while Germany’s fiber optic rollout presents a promising growth avenue. Meanwhile, the company is working to improve profitability in Italy, Spain, and the UK.

The big question is whether Solutions 30 can stick to its strategy and prove to investors that its new model is working. Visibility remains limited, and the company still faces risks in some of its key markets.

Until it can show consistent execution and a return to sustained growth, investor confidence may remain cautious.

Symrise (SY1) Solid numbers, but inflationary pressures linger

Symrise wrapped up Q4 with €1.175 billion in sales, slightly ahead of expectations. However, organic sales growth was just 0.9%, well below estimates. The biggest culprit? A -5 percentage point hit from hyperinflation, particularly in Latin America. Adjusting for that, growth would have been a healthier 6%, but the overall slowdown compared to Q3 raises some concerns.

On the positive side, Symrise’s EBITDA came in at €1.033 billion, slightly above estimates, with a solid margin of 20.7%. The company’s cash flow performance was also strong, with business free cash flow exceeding expectations. These numbers show that despite the sales slowdown, Symrise is managing its costs and maintaining financial discipline.

Looking at its business segments, the Taste, Nutrition & Health division struggled, posting a -0.7% decline in organic growth due to inflation pressures. However, the Scent & Care segment fared much better, growing by 3.9% and aligning with forecasts. It’s worth noting that competitors like Givaudan have seen stronger growth in fragrance-related sales, suggesting that Symrise may still have some catching up to do in certain areas.

For 2025, Symrise is targeting organic sales growth of 5-7% (excluding hyperinflation effects) and an EBITDA margin of around 21%. This outlook is in line with market expectations, meaning it likely won’t trigger any major changes in analyst forecasts.

While the company’s long-term growth story remains intact, the near-term slowdown and inflation-related headwinds suggest that 2025 will be more about steady recovery rather than a rapid rebound. Investors will be keeping a close eye on whether the company can reaccelerate its organic growth as inflationary pressures ease.

WDP (WDP) Strong results and a clear market recovery in sight

WDP delivered an impressive set of results for 2024, comfortably beating expectations and providing a confident outlook for 2025.

The logistics real estate specialist raised its EPRA EPS guidance for the year and confirmed that it sees a turning point in the rental market cycle. Management noted that demand is picking up, retention rates are normalizing, and occupancy has improved to over 97%.

These trends suggest that after a period of market weakness, logistics real estate is starting to recover.

The company also saw fair value gains of 2% for the year, reflecting improving property valuations and latent capital gains from recent acquisitions. WDP has been actively expanding its investment pipeline, which now stands at over €1.1 billion.

This is a notable jump from the €600 million level seen in Q3, driven by strategic acquisitions that are expected to generate solid long-term returns. However, pre-letting rates fell slightly to 60% in Q4 due to an early lease termination in Romania—something to keep an eye on, but not a major red flag given the overall improving environment.

Financially, WDP remains in a strong position, with an average cost of debt at just 1.9% and an LTV ratio of 39.3%. The company expects business free cash flow to reach around 14% of sales in 2025, reinforcing its solid balance sheet.

The broader logistics real estate market appears to be emerging from its downturn, and WDP is well-positioned to capitalize on this shift.

That said, its valuation is already reflecting some of this optimism, and while the stock has upside, investors looking for stronger growth potential might find better opportunities among its peers.

Roche (ROG) 2025 looks less exciting

Roche wrapped up 2024 with steady, predictable results that largely met expectations.

Group sales rose 7% at constant exchange rates, driven by strong performances in the pharma division. Key drugs like Vabysmo, Hemlibra, and Phesgo continued to gain traction, offsetting some weakness in other areas. However, Roche is still facing challenges from biosimilar competition, particularly for Actemra and Tecentriq, which could weigh on future growth.

The diagnostics segment was slightly weaker than expected, and while core EBIT improved, it wasn’t a game-changing beat. The company’s margin expanded to 34.4% from 32.8% in 2023.

Overall, Roche’s 2024 performance was solid but unspectacular—meeting expectations without delivering any major surprises.

Looking ahead to 2025, Roche provided cautious guidance, forecasting mid-single-digit sales growth and high-single-digit EPS growth. This suggests a slowdown as some of its key products reach maturity and face more competition. The company also flagged a CHF 1.2 billion headwind from loss-of-exclusivity impacts, which will be a drag on performance.

Where Roche gets more interesting is in its pipeline.

The company has several major clinical trial readouts coming in 2025, including phase III results for giredestrant (a breast cancer treatment), astegolimab (for COPD), and fenebrutinib (for multiple sclerosis). Positive results from any of these programs could shift sentiment and drive a re-rating of the stock.

At its current valuation, Roche is trading at a premium compared to its peers, yet its expected earnings growth is weaker. The stock remains a high-risk, high-reward bet, with potential catalysts in the pipeline but little near-term excitement.

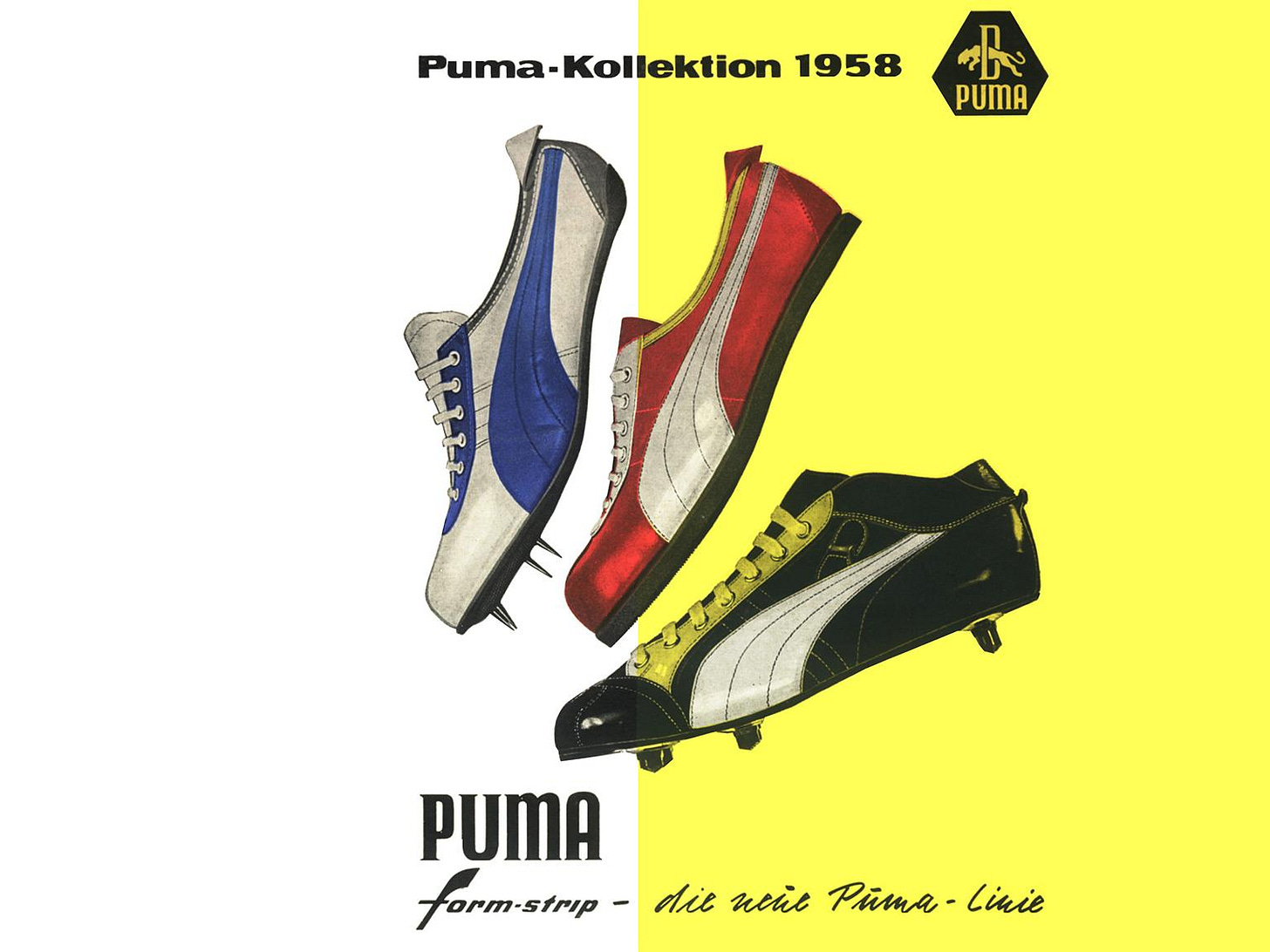

Puma (PUM) What went wrong and what’s next?

Puma’s Q4 results were 'muah’, and after last week’s profit warning, management took to a conference call to provide some much-needed clarity. The biggest question on everyone’s mind? Why did EBIT fall short of expectations?

To recap, Q4 sales grew 10% at constant FX, which was slightly below the consensus of 11-12%. But the real disappointment came on the profitability front—EBIT came in at €109m, significantly missing the €130m that analysts had expected.

Management pointed to a weaker-than-expected performance in Latin America and China, coupled with higher promotional activity, which hurt profitability more than anticipated. The wholesale segment was also underwhelming, growing just 7%, with flat re-orders, while direct-to-consumer (DTC) was stronger at 16% growth but still below internal forecasts.

A major focus of the call was the new “nextlevel” efficiency program, which aims to lift EBIT margins to 8.5% by 2027 (from 7% in 2024). Puma acknowledged that higher sourcing costs—driven in part by the strong US dollar—meant they needed to tighten cost controls. The plan involves simplifying procurement, reallocating resources, and shifting more investment toward marketing (with a goal of a 10% marketing-to-sales ratio).

Interestingly, Puma emphasized that short-term sales optimization isn’t the goal—itá the long game, focusing on brand equity and full-price realization, which is currently below the industry average.

While the call gave more color on why Q4 EBIT missed, it left some questions unanswered—notably, how regional profitability trends played out and how gross margins will evolve.

Right now, Puma is trading at roughly 12.5x P/E for 2025, significantly below its three-year average of 19x. That suggests a lot of bad news is already priced in—so if Puma can deliver a convincing roadmap for 2025, sentiment could turn quickly.

DSM-Firmenich (DSFIR) ANH taking the lead

DSM-Firmenich is riding a wave of continued growth, and Q4 2024 looks set to keep that momentum going.

The combination of strong market demand, favorable conditions, and internal efficiency efforts is paying off. The company is also benefiting from temporary tailwinds, such as vitamin supply disruptions, which are expected to contribute €80m in Q4 2024.

One of the biggest stories of this quarter is the Animal Nutrition & Health (ANH) segment, which is seeing major improvements thanks to higher vitamin prices and restructuring efforts. ANH could soon be generating €125m in adjusted EBITDA per quarter, positioning it well for a future separation from the company.

Meanwhile, Perfumery & Beauty continues to be a key value driver. Taste, Texture & Health is still benefiting from post-destocking recovery and synergies, while Health, Nutrition & Care is getting a modest boost from rising vitamin prices.

With volume trends improving and self-help initiatives delivering results, the company is well-positioned to strengthen its portfolio, improve efficiencies, and ultimately rerate its valuation. If DSM-Firmenich can successfully execute its strategy, 2025 could be a pivotal year for the company.

Swatch Group (UHR) A rough year

Swatch Group just wrapped up a brutal 2024, with sales down 12.2% for the year and a shocking drop in profitability—the EBIT margin collapsed from 15.1% in 2023 to just 4.5% in 2024. The second half of the year was particularly bad, with sales declining 14% and margins barely holding at 3%.

The worst-hit region? China, where sales plummeted 30%, dragging down the group’s overall performance.

Adding to the pain, higher marketing costs for the Olympics and poor inventory management weighed heavily on profits. Swatch’s net cash position shrank by CHF 600m, and the dividend was slashed to CHF 4.5 per share, down from CHF 6.

But it’s not all bad news. December showed signs of life, with strong double-digit growth in the US and UK, and brands like Omega, Tissot, and Hamilton performing well. That momentum seems to be carrying over into January, particularly in the US. Swatch expects positive growth in local currencies for 2025, with a goal (not official guidance) of 5-10% sales growth. However, management remains cautious on China, suggesting a slow and uncertain recovery.

The big question is whether Swatch can turn things around. The company is hoping for significant operating leverage, meaning even modest sales growth could drive strong margin recovery. However, given the uncertain macroeconomic environment and challenges in brand positioning, it’s going to be a long road back.

EBIT margins could be improving, but will still be far from Swatch’s historical profitability levels.

Swatch isn’t out of the woods yet, but if the US and UK trends hold up, and China shows even slight improvement, 2025 could mark the start of a slow recovery.

STMicroelectronics (STM) Uncertain recovery ahead

STMicroelectronics’ latest call painted a cautious picture, with a weaker-than-expected Q1 forecast and little clarity on when things might improve.

The company acknowledged ongoing inventory corrections in the automotive and industrial sectors—two segments that make up over 60% of its sales—suggesting that any real recovery may still be months away.

With Q1 sales projected at just $2.51 billion, a steep 24.4% drop from the previous quarter, and a gross margin forecast of 33.8% (significantly below expectations), it’s clear the company is still dealing with significant headwinds. The book-to-bill ratio remained below 1 in Q4, reinforcing concerns about sluggish demand.

Management refrained from offering guidance for the full year, another sign that visibility remains extremely limited.

That said, there were some positives. The company highlighted opportunities in general-purpose CPUs, where it’s already gaining market share, and in silicon carbide (SiC), particularly in China. While STMicroelectronics didn’t provide a specific 2025 outlook for SiC sales, management expressed confidence in its strong customer base in this segment.

Despite a better-than-expected Q4—driven in part by R&D subsidies that helped boost operating income—the market remains focused on the challenging near-term outlook.

With earnings estimates for 2025 and 2026 now significantly reduced, STMicroelectronics is trading at c. 8x forward EBITDA, close to its historical average but not exactly compelling given the uncertain recovery timeline.

For now, the company needs to navigate through continued inventory corrections, stabilize margins, and wait for demand in key markets to pick up.

Rémy Cointreau (RCO) Cognac struggles persist, but upside potential remains

Rémy Cointreau’s latest update confirms what many had feared—the cognac market downturn continues to weigh heavily on results.

The biggest pain point remains indeed cognac, which makes up 65% of group sales. The category will fall strongly with the U.S. market yet to show meaningful recovery and China facing additional challenges due to tougher year-over-year comparisons and cash constraints among distributors.

Meanwhile, the Liqueurs & Spirits division is expected to decline by 8%, an improvement over the previous quarter, largely thanks to better trends in Europe and Asia-Pacific.

EBIT will be strongly down from the previous year; while the company has managed to hold the line on costs, the reality is that the downturn in demand has been too sharp to offset.

Looking ahead, the real question is when the cognac market will turn the corner.

Rémy Cointreau has historically been one of the best-positioned players in the premium spirits space, and when demand does rebound, the company should benefit more than most. However, without clearer signs of improvement in the U.S. or China, it may take longer than investors had hoped.

While the stock has already been hit hard by the downturn, more clarity on consumer trends—particularly in the crucial U.S. market—will be needed before sentiment starts to improve. Until then, Rémy remains a waiting game, though the long-term upside remains intact once the cycle turns.

If you appreciate this post, feel free to share and subscribe below!